Imagine waking up at night, heart racing, worried about a medical bill or job loss wiping out your savings. Surveys show over 60% of Americans live paycheck to paycheck, haunted by money fears that strain families and health. You don’t have to stay trapped in that cycle. The “Financial Protection Blueprint” offers a clear path out—packed with proven steps to build security, all for free. Grab it now and start shielding your future from uncertainty.

Why Financial Peace Is Your Family’s Most Valuable Asset

Financial peace means more than a full wallet. It brings calm sleep, less family fights over bills, and freedom to enjoy life. This guide shows you how to claim that peace without complex plans or big fees.

Defining True Financial Freedom vs. Wealth Accumulation

True freedom feels like a safety net under your dreams, not just piles of cash in a bank. Wealth might buy houses, but peace keeps stress away during tough times. Studies from groups like the American Psychological Association link strong money habits to lower anxiety and better moods. The blueprint teaches you to chase security first, so wealth follows naturally.

The Hidden Costs of Procrastination

Delaying your money plan costs you big. Missed chances to grow savings mean smaller nests later. For example, starting an emergency fund at 30 beats waiting till 40—compound interest could double your pot. Higher rates on old debts pile up too. The blueprint pushes you to act fast, saving thousands in the long run.

Who Needs This Blueprint Most?

New parents juggling baby costs top the list. They worry about unexpected expenses like daycare hikes. Recent grads drowning in student loans find quick relief here. Folks near retirement check their safety nets before it’s too late. No matter your spot—young or old, single or with kids—this free tool fits everyone. It adapts to your life stage for real results.

Deconstructing the Blueprint: Core Pillars of Financial Security

The “Financial Protection Blueprint” boils down protection to simple pillars. Each one builds a strong base for your money life. Dive in, and you’ll see easy ways to fix weak spots right away.

Pillar 1: Emergency Fund Mastery

Start with cash you can grab fast for surprises. Aim for three to six months of living costs—say $10,000 if your bills run $2,000 monthly. Keep it in a high-yield savings account for easy access without fees. The blueprint walks you through building it step by step, even on a tight budget.

Pillar 2: Debt Demolition Strategies

Knock out debts like a pro wrestler pins foes. Pick the snowball method: pay smallest bills first for quick wins that boost your drive. Or go avalanche: hit high-interest ones to save cash long-term. This guide gives checklists and trackers to make it simple. You slash payments and free up money for fun sooner.

Pillar 3: Essential Insurance Foundations

Life throws curveballs, so cover basics. Get term life insurance if you have dependents—it’s cheap peace. Disability policies guard your income if illness hits. Health plans prevent medical debt bombs. The blueprint helps you spot gaps in what you own now. It lists questions to ask agents without getting upsold.

Mastering Risk: The Protection Layer in Your Financial Plan

Protection isn’t optional; it’s your shield against life’s storms. The blueprint spotlights this layer to keep small issues from becoming disasters. Build it strong, and worries fade.

Identifying and Mitigating Unforeseen Catastrophes

Job cuts or car wrecks happen fast. Stats say one in five families face a big hit yearly, like a health crisis draining $50,000. The guide maps risks with a personal quiz. Then, it suggests buffers—like extra savings or riders on policies—to blunt the blow. You learn to spot threats early and act.

Real-World Scenario: When Plans Fail (And How the Blueprint Prevents It)

Picture Sarah, a mom of two, who lost her job during a recession. Without prep, her family scraped by on credit cards, racking up interest. But if she’d followed the blueprint, an emergency fund would have covered six months. Plus, disability coverage kept income flowing. Her story shows prep turns panic into recovery. Yours can too—with these free steps.

Actionable Tip: Performing Your Annual Financial Health Checkup

Review your setup once a year, like a car tune-up. Step one: List all debts and interest rates; cut the worst first. Step two: Check insurance dates and coverage amounts—update for life changes like a new baby. Step three: Tally your emergency pot; add if it’s low. The blueprint includes a printable sheet for this. Do it now, and stay ahead.

Beyond Survival: Setting the Stage for Future Growth

Protection stops the bleeding, but growth builds wealth. The blueprint shifts you from guard mode to build mode seamlessly. Secure your base, then watch opportunities bloom.

Aligning Savings Goals with Protection Milestones

Lock in your fund and coverage before chasing big dreams. Think of it as laying bricks before the roof. Hit those marks, and savings flow easier to goals like college funds. The guide timelines this—protect in year one, save big in year two. It keeps you balanced, avoiding rash risks.

Introduction to Low-Stress Investing Principles

Investing scares many, but the blueprint simplifies it. Start with index funds that track the market—no daily watch needed. Diversify across stocks and bonds for steady gains, say 7% yearly average. Avoid hot tips; stick to boring, reliable picks. This approach fits peace seekers, growing money while you sleep.

Utilizing Free Resources Effectively (Where the Blueprint Fits)

Skip pricey apps at first. Use library books or government sites for basics. The blueprint acts as your roadmap, pointing to these gems. It sorts what’s worth your time, so you avoid info overload. Pair it with free calculators online, and you’re set without spending a dime.

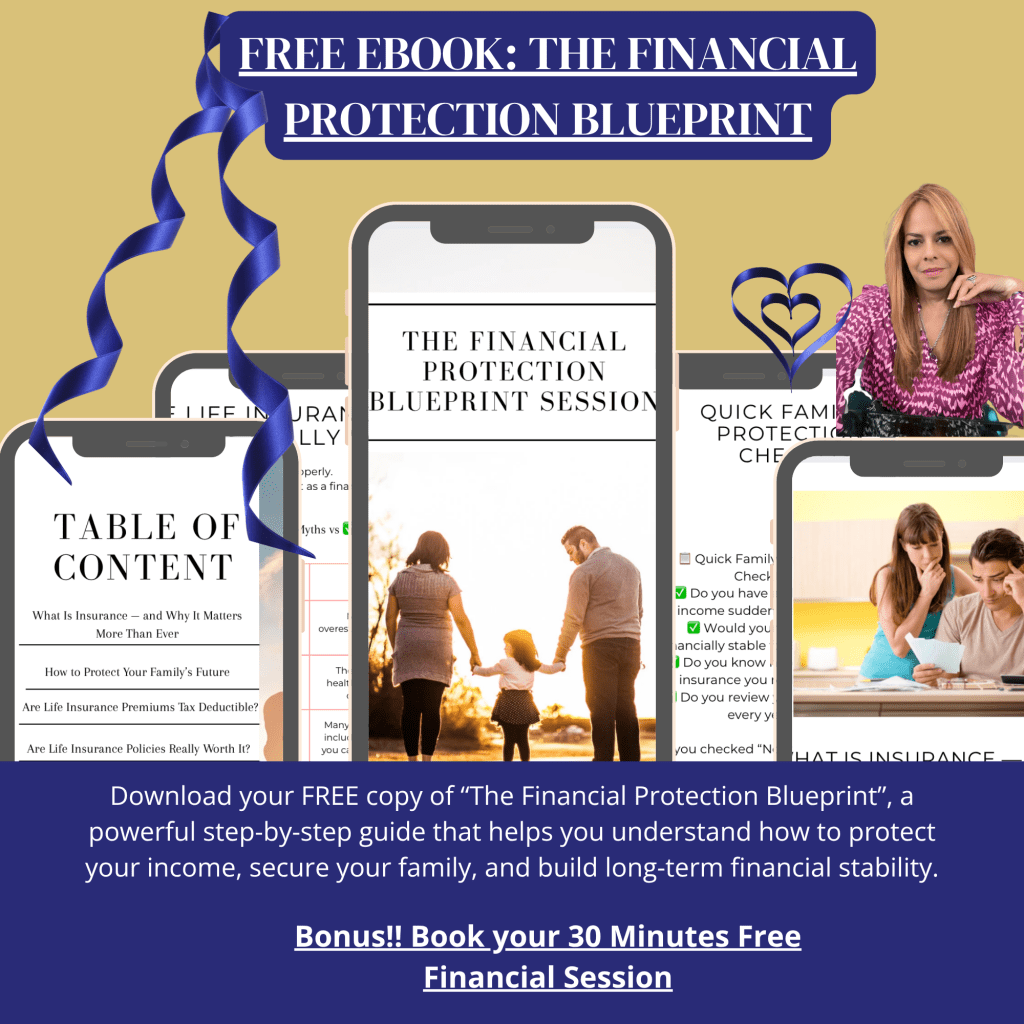

Your Next Step: Securing Your Free Financial Protection Blueprint

Ready to ditch money stress? Download the blueprint today—it’s your ticket to control. No tricks, just solid advice waiting for you.

What Happens Immediately After Downloading?

Click the link, enter your email, and get the PDF in seconds. Open it on any device; no apps required. Dive into sections at your pace. Best part: zero cost, no sales pitches follow.

Testimonials or Success Indicators (If Applicable)

Thousands have grabbed this guide and found clarity. One user said, “It cut my worries in half—now I sleep better.” Another parent noted, “Built my fund in months, thanks to the steps.” Real folks trust it for real change.

The Cost of Inaction: A Final Thought

Wait too long, and small problems snowball into regrets. A missed coverage gap could cost your family everything. Claim this free blueprint now. Turn “what if” into “I’ve got this.”

Conclusion: Claim Your Control, Starting Now

The “Financial Protection Blueprint” swaps fear for confidence with easy, proven tools. It covers protection basics to spark growth, all without a penny spent. You deserve this peace—download it and step into a secure tomorrow.

- Financial peace comes from smart shields, not just big paychecks.

- The blueprint hits key areas: savings buffers, debt busting, and risk covers.

- Control starts simple; your free copy makes it happen.

Leave a comment